An experienced retirement planning expert living in San Diego, Brian Gibbs has served as the president and CEO of Heritage Retirement Advisors for more than 15 years and has over 40 years of financial services experience. He holds a number of certifications from the American College of Financial Services, such as the RICP, or Retirement Income Certified Professional. At the San Diego-based firm, Brian Gibbs specializes in charitable trusts, mortgage analysis and strategy, retirement planning, life insurance and equity-indexed annuities.

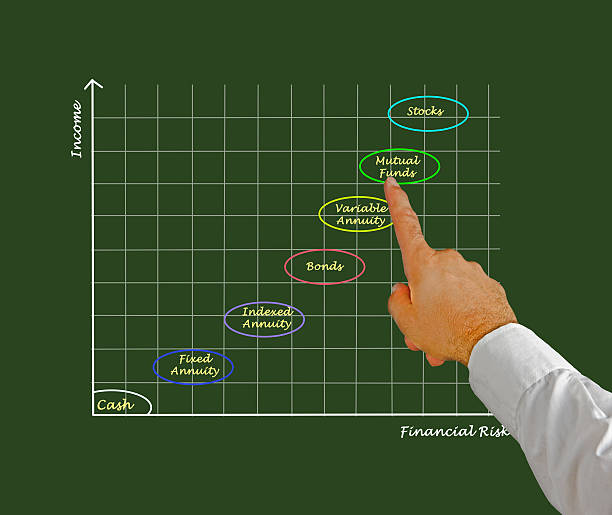

An equity-indexed annuity pays an interest rate based on a stock or equity index, usually the S&P 500 (Standard & Poor’s 500 Composite Stock Price). Generally, moderately conservative investors prefer these annuities, since they enable them to earn a higher return than they would through traditional fixed annuities but still give a degree of protection from downside risks.

Most fixed annuities calculate interest based on a rate set in the original contract. The interest is calculated by using a formula based on the index to which the annuity is linked. However, equity-indexed annuities guarantee a minimum interest rate, which is generally 1 percent to 3 percent of the premium paid.

An important feature of an index annuity is that it limits the rate at which a market owner can benefit from market gains. As collateral for limiting profits, investors get of a higher level of protection against downside risks and losses. Nevertheless, equity-indexed annuities are a relatively complex instrument that amateur investors may need assistance from annuity experts to successfully navigate.